Key Investment Criteria for Venture Capital (VC) / Private Equity (PE) Funds

Venture Capital (VC) / Private Equity (PE) Funds are looking for investment in enterprises offering potential for attractive growth and earnings.

Indicative Investment Criteria are :

High Entrepreneurial Drive : VC & PE Funds will consider an investment opportunity only where they find high entrepreneurial drive in the promoters of the company and who have ambition to take the company to the next level. For the purpose, presence of strong top management team with proven ability will get due consideration.

High Scalability & Non-cyclical Business : VC & PE Funds are looking for businesses which have high scalability and can reap dividend by quickly and cost effectively reaching to its target customers. They would be interested in sectors which are relatively insulated from periodic downturn of the economy.

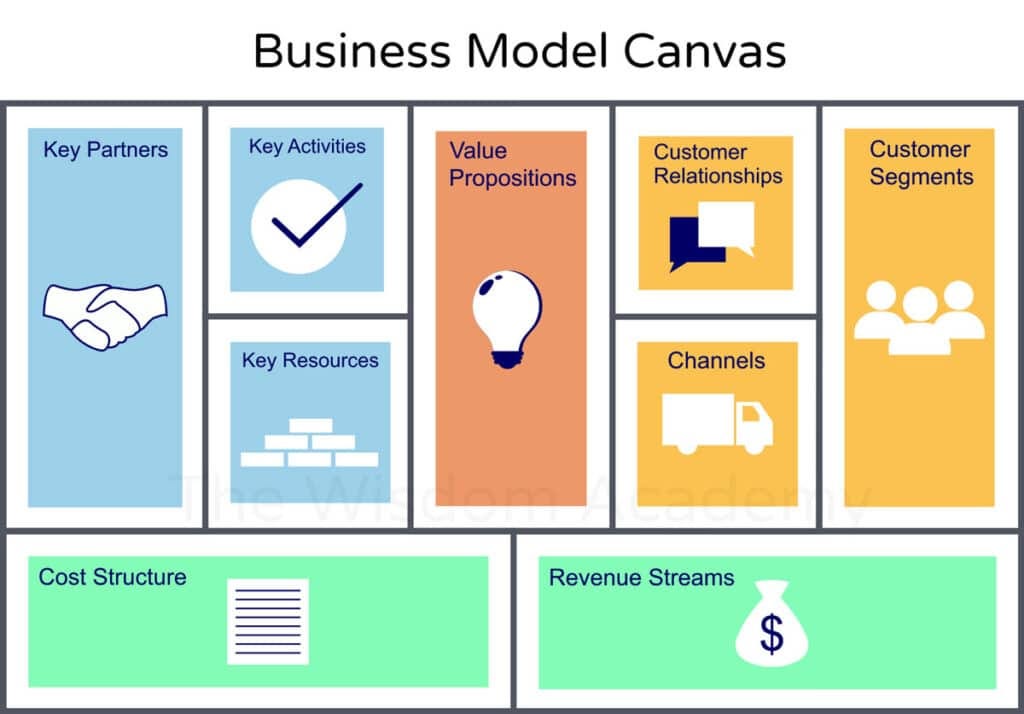

Sustainable Competitive Advantage : VC & PE Funds prefer to invest in innovative business models with a sustainable competitive advantage.

A Clear Exit Plan : They seek to invest in ventures with clear strategy for exit within a reasonable time period in order to create and realize the value in the investment.

Mode of Investment :

VC & PE Funds would invest primarily by way of investments in privately negotiated equity / equity related and / or convertible / non-convertible debt instruments in unlisted companies.

They shall also endeavor to provide mentoring support and other value additions to enable the investee companies achieve rapid growth and achieve / maintain their competitive edge in international markets.

#startup #funding #vc #pe #venturecapital #privateequity